The revenue ranking of the top ten global wafer foundries in Q2 is released: the output value hits a

发布时间:2021-09-09

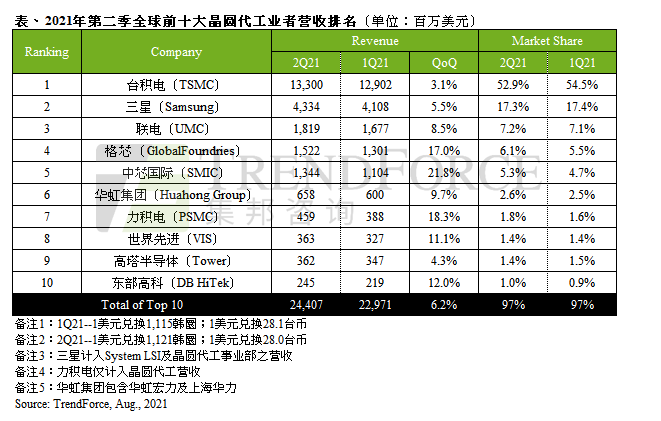

The latest survey report pointed out that Q2 global foundry production value reached 24.407 billion US dollars, a quarterly increase of 6.2%, setting a record high for the eighth consecutive quarter since Q3 2019. In terms of TOP 10 revenue rankings, Q2 TSMC with a revenue of 13.30 billion US dollars, firmly seated on the throne of the global foundry "big brother", Samsung came second, and UMC ranked third...

According to Trend Force's survey, the panic stocking tide caused by post-epidemic demand, communication generation conversion, geopolitical risks and long-term shortages continued to burn in Q2, and various terminal products that could not meet the shipment target due to foundry capacity limitations were stocked. With unrelenting strength, and driven by the successive output of Q1 price increase wafers, the output value of Q2 foundry reached US$24.407 billion, a quarterly increase of 6.2%, setting a record high for 8 consecutive quarters since Q3 of 2019.

TSMC and Samsung were affected by power outages, and the quarterly revenue growth rate was slightly limited.

Taiwan Semiconductor Manufacturing Company (TSMC) Q2 revenue reached 13.30 billion US dollars, a quarterly increase of 3.1%, ranking first in the world. Its revenue growth was limited by the power trip incident in Nanke’s Fab14 P7 plant in April, which resulted in a small number of 40nm and 16nm wafers being scrapped; and the power trip of Taipower’s Kaohsiung Xingda Power Plant in May, and the fab in Nanke suffered the most direct impact is that despite the timely operation of the generators in the factory, so that the online wafers will not be scrapped, there are still some 8-inch wafers that need to be reworked. In addition, because TSMC maintains a consistent and stable quotation strategy, although Q2 revenue performance is higher than the upper limit of the company's financial guidance, the quarterly growth rate is slightly lower than that of the remaining fabs, and the market share has been slightly eroded.

Samsung (Samsung) Q2 revenue was 4.33 billion U.S. dollars, an increase of 5.5% quarter-on-quarter. After getting rid of the heavy snow in Texas in February, Samsung Line S2 in Austin has fully resumed production in early April, and is fully increasing production orders to make up for the plant. Nearly one and a half months of filming loss. Although the sharp drop in Q1 film production slightly affected Q2 output, resulting in a slight restriction on the quarterly growth rate,However, driven by the strong sales of CIS, 5g RF transceiver, OLED driver IC and other products, the revenue performance is still bright.

The third-ranked UMC, UMC is still benefiting from demand driven by PMIC, TDDI, Wi-Fi, OLED driver ICs, and its capacity utilization rate has exceeded 100%, which is seriously in short supply. Therefore, it continues to increase prices for customers; plus prices Higher 28/22nm new production capacity has been opened one after another, driving the Q2 average selling price to rise by about 5%, pushing up revenue to 1.82 billion US dollars, an 8.5% quarterly increase, and the market share is roughly the same at 7.2%.

Global Foundries ,Q2 revenue increased by 17.0% quarter-on-quarter, reaching 1.52 billion US dollars, ranking fourth. After selling Fab10 in the US and Fab3E in Singapore to ON Semiconductor and World Advanced in 2019, it has gradually converged its product lines, focusing on 14/12nm Fin FET, 22/12nm FD-SOI, and 55/40nm HV and BCD process technologies. At the same time, it announced the expansion of existing product line production capacity. There are plans to build new plants in the United States and Singapore respectively. It is expected to contribute revenue from the second half of 2022 to 2023. Although Fab10 has been sold to ON Semiconductor, the plant will be in 2020 to 2021. The company continued to manufacture products for ON Semiconductor until the completion of the delivery in 2022 before being handed over to ON Semiconductor for independent operation.

SMIC, Q2 revenue increased by 21.8% quarter-on-quarter to US$1.34 billion, and its market share also increased to 5.3%. The main momentum came from 0.15/0.18um PMIC, 55/40nm MCU, RF, HV, CIS, etc. The demand for this process is strong, and the price of wafers has also been continuously increased. In addition, the 14nm new customer introduction progress is better than expected, and the 15Kwspm production capacity is currently at full capacity.

Hua Hong Group's consolidated revenue ranking jumped to sixth, the world's advanced surpassed Tower Semiconductor

Since both HHGrace and HLMC belong to HuaHong Group, they operate Fab1/2/3/7 and Fab5/6 respectively, and some of their manufacturing resources circulate each other, so this time The two are combined and calculated as Hua Hong Group; the capacity expansion of Fab7 in Hua Hong Wuxi is faster than expected, and customers such as NOR Flash, CIS, RF and IGBT have strong pulling force. The current 48Kwspm production capacity has reached full capacity operation, plus 8 inches The production capacity of the factory maintained a utilization rate of more than 100%, and the average unit price of wafers increased by 3-5% quarter by quarter. In Q2, Huahong Group's revenue increased by 9.7% quarterly, ranking sixth with US$660 million.

After Power Semiconductor Manufacturing (PSMC) surpassed Tower for the first time in the revenue ranking of Q1, Q2 still maintains strong growth momentum. P1/2/3 plants including Specialty DRAM, DDI, CIS and PMIC products continue to invest; 8A/B plant IGBT When the demand for vehicles has risen sharply, driven by the quarterly increase in overall prices, revenue has reached 460 million US dollars, an increase of 18.3% on a quarterly basis, ranking seventh.

Driven by multiple favorable factors such as the maintenance of demand for DDI, PMIC, power discrete, etc., the new production capacity of Fab3E in Singapore, the adjustment of product mix, and the continued increase in average unit price, Q2 revenue increased by 11.1 quarterly. % Surpassed Tower Semiconductor for the first time, reaching 363 million US dollars.

The ninth-ranked Tower Semiconductor (Tower) has stable demand in the RF-SOI and industrial and automotive PMIC fields. However, due to the fact that new capacity is not yet in place, revenue only slightly increased by 4.3% quarterly, and Q2 revenue reached 360 million US dollars .

DBHiTek has maintained a full load level for more than one and a half years. The demand for 8-inch PMIC, MEMS, and CIS has contributed steadily. The increase in revenue is mostly due to the increase in average unit price. Q2 revenue was US$245 million, a quarterly increase of 12.0%.

Looking forward to Q3, the shortage of foundry capacity has been delayed for nearly two years since the second half of 2019. Although some new capacity has been released one after another, due to the limited increase, from the order observation, the new capacity has also been booked. The capacity utilization rate of the foundry is generally maintained at the full load level and continues to be in short supply. In addition, since Q2 of this year, the automotive chip has been greatly increased by the governments of various countries, and the capacity has been expanded. This has led to the foundry the average selling price continued to rise, and each factory adjusted its product mix to improve profitability.

返回列表

返回列表